Stocks Tracker: Fears around Trump’s tariffs impact US operators as market caps shrink

EGR North America analyses the share price movements of major industry players, including Flutter Entertainment and DraftKings

Flutter Entertainment

3 March closing: $271

31 March closing: $222

Peak March closing: $271

It was a tough March for operator giant Flutter, with the FanDuel parent company seeing its market cap reduced by more than $9bn, falling just shy of 25% of its all-time peak of around $50bn in mid-February, though Flutter’s market cap remains the sector’s largest.

As is the case for several US-facing consumer businesses, the slump in share value came as a result of lingering concerns related to President Donald Trump’s tariff plans and the looming possibility of a recession.

The US has been engaged in a trade war with several countries, which first began in early March, and has sparked fears of a consumer slowdown.

Flutter’s lowest point came on the month’s final day, with the FanDuel parent company bringing March to a close with its stock price at $221.55, a steep decline from February’s high of marginally below $300 per share.

The start of the month started strongly, however, with Flutter reporting full-year 2024 revenue of $14bn, up 19% year on year, with a 13% increase in average monthly players.

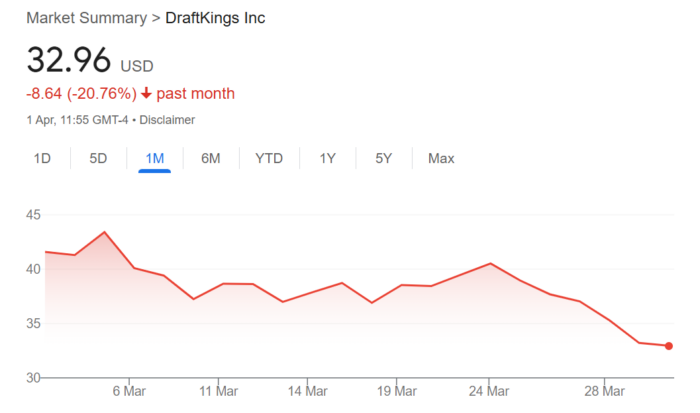

DraftKings

3 March closing: $42

31 March closing: $33

Peak March closing: $43

In a month where Flutter CEO Peter Jackson described DraftKings as Flutter’s “number one enemy”, the Boston-based company’s shares followed a similar fate, sliding on the Nasdaq by almost 20%.

By the end of March, DraftKings’ market cap had reduced by $4.4bn, leaving its overall market cap more than $20bn short of Flutter’s.

The month’s peak of $43.41 came one day after CEO Jason Robins discussed the prospect of international expansion, in which he said that while it could distract from its core US efforts, it would be “irresponsible” not to consider the idea.

However, less than 48 hours later, DraftKings’ per share price had fallen below the $40 mark, and though it would briefly reach it again on 24 March, the operator’s stock value remained on a downward trajectory from that point on, largely due to the same reasons as its rival FanDuel.

Genius Sports

3 March closing: $8

31 March closing: $10

Peak March closing: $11

In stark contrast to the operators, supplier Genius Sports saw its shares surge by 20% by the end of March.

The month began in strong fashion, with the company releasing its full-year 2024 results that included a 23.7% YoY increase in revenue to $510.9m, alongside a 60.7% YoY rise in adjusted EBITDA, posted at $85.7m.

However, the firm’s share price fell 5.1% between 10 March and 11 March amid concerns surrounding Trump’s tariff strategy. The decline did not last as just over a week later Genius’ stock had surpassed the $10 per share mark.

The supplier has received public backing from several high profile investment banks in recent months, including Macquarie, Goldman Sachs Lake Street Capital, with the latter raising its price objective on the stock while issuing a buy rating on the supplier’s shares.

Genius Sports has set 2025 growth targets for revenue and adjusted EBITDA at 21% and 46%, respectively.

Gambling.com Group

3 March closing: $14

31 March closing: $13

Peak March closing: $14

The Nasdaq-listed affiliate did not evade the impact Trump’s tariffs had on several key players within the sector, slumping to its lowest point on 13 March when Gambling.com Group’s shares fell to $11.67.

However, one week later, the firm posted its Q4 performance that included a 9% YoY rise in revenue and a climb of 39% YoY for adjusted EBITDA. That resulted in the affiliate’s stock closing at $13.33, up from a previous close of $12.48.

CEO Charles Gillespie told analysts during the subsequent investor call that the increase in popularity of sports event contracts serves as a “clear, strong positive” for Gambling.com Group.

Soon after, the affiliate’s stock tracked upwards once again, reaching its peak of $13.92 five days after the results being published, before a decline left the company closing the month at $12.62, representing a decline of 7.6% since the start of March.