Robinhood CEO: Event contracts are the future of trading and news

Vladimir Tenev maintains his bullish rhetoric around the emerging sector, despite company pulling Super Bowl contract under pressure from the derivatives regulator

Robinhood CEO Vladimir Tenev has said event contracts represent the future of both trading and news after the retail brokerage firm dipped its toe into the sector last year.

Speaking at the Citizens JMP Technology conference yesterday, March 4, Tenev was asked for his thoughts on event contracts after Robinhood pulled its Super Bowl offering less than 24 hours after launch.

The product, powered by Kalshi, was shuttered following pressure from the Commodity Futures Trading Commission (CFTC). However, Robinhood has pledged to deploy a “comprehensive” platform this year.

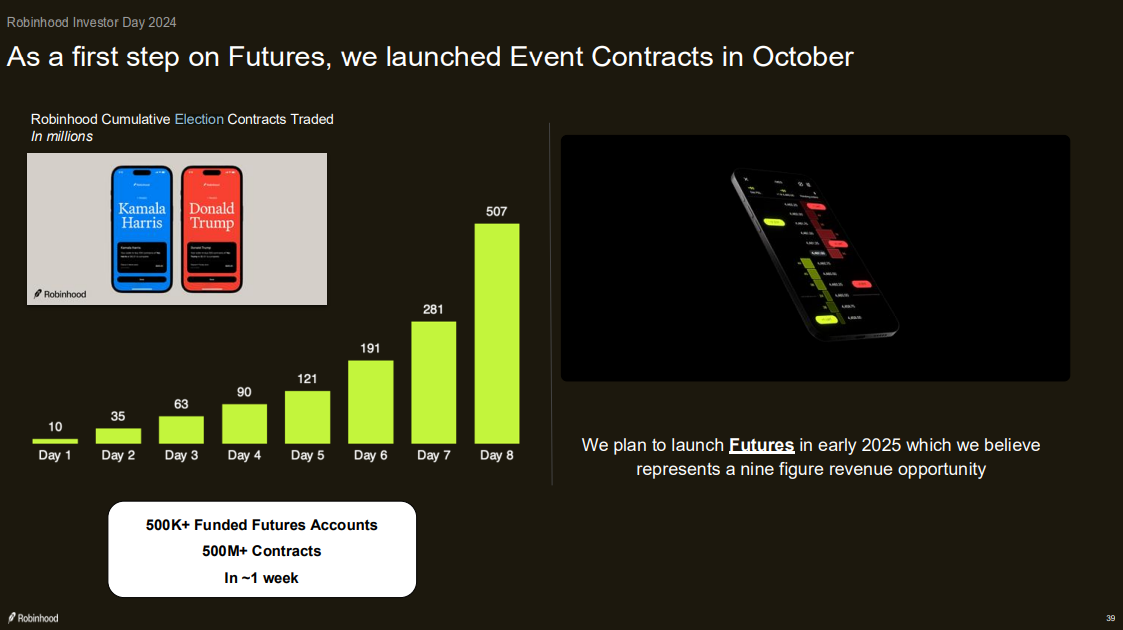

The California-based company joined Kalshi in offering markets on the US presidential election in November, in which it saw more than 500 million contracts traded in the week leading to November 5.

And while Robinhood has not followed Kalshi and Crypto.com into offering sports event contracts, at the time of writing, Tenev painted a picture of the company firmly being in the foreground in the future.

He said: “What we saw was [that] demand for that product was extreme. We were already planning on having prediction markets being one of the big new features that we rolled out.

“[The election] gave us a lot more confidence that not only do we believe in it, but that customers actually want it, it’s legitimately useful and it could fit in alongside all the other trading assets they use.”

Moving away from the sports event contracts space, which has drawn ire from some quarters for effectively deploying legalized sports betting in all 50 US states, Tenev predicted a greater meshing between the product and media.

Kalshi’s proponents praised the platform for predicting Donald Trump would emerge victorious against Kamala Harris in November, so much so that the president’s son, Don Jr, has joined Kalshi as a strategic adviser.

Looking ahead, Tenev said: “I think [event contracts] are the future of trading. They’re also the future of news. You get great price discovery, and you get, what I think, is the best mechanism for distilling information down to an accurate prediction.

“I think what it will look like will be a [similar to] the newspaper. You’ll have a front page which will be all the relevant news and events that you want predictions on that are trending right now. Then there’ll be a sports section, a style section, business, and economic news.

“And essentially, the next iteration of news and information will be integrated with markets so that you get a clear picture of all the information that’s out there in real time and what it means for the future. It’s like the news before it happens, which I think is extremely valuable.”

Outside of sports, Kalshi’s platform currently has markets stretching across politics, culture, health, and crypto price prediction.

For example, Kalshi users can trade on the temperature in New York, how much government spending Elon Musk’s Department of Government Efficiency will cut this year and stock exchange closing prices.

President Trump has also nominated Kalshi board member Brian Quintenz as the CFTC’s new chair, suggesting a pro-event contracts stance for the US derivatives regulator in the near future.

However, Nevada regulators have now demanded Kalshi cease operating in the state.