Major US-listed gambling firms suffer stock slump in light of Trump’s tariff war

Flutter, DraftKings and Caesars Entertainment among those to report stark declines in share price as US markets shrink following Trump’s refusal to rule out 2025 recession

The US stock markets saw a significant sell-off of shares yesterday, March 10, amid rising concerns from investors over the financial impact of President Donald Trump’s tariffs plans.

The sharp slump came in the aftermath of Trump’s response to questions over whether the US could be plunged into a recession this year as a result of the trade war with multiple countries, including neighbours Canada.

Trump has also trained his sights on China with tariffs, along with Mexico. The European Union has likewise drawn the ire of the president in recent weeks.

By market close on Monday, the S&P 500 had fallen nearly 3%, while the Nasdaq had also followed a similar downward trajectory. In the last five days, the Nasdaq’s value has declined by more than 10%.

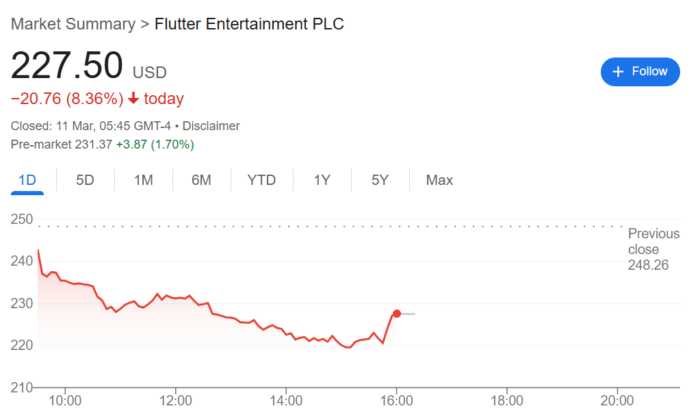

Such market uncertainty has had a significant impact on major US-listed operators, with New York-listed Flutter Entertainment’s shares falling by 8.4% at the time of market close on Monday, sitting at $227.50 per share.

In mid-February, the group’s shares reached a record-high of just under $300, though the firm has since lost $5bn in market capitalization. The operator still has the sector’s largest market cap, at just over $40bn.

Similarly, Nasdaq-listed operator DraftKings saw its stock price fall 5.5% to $37.24 by close on Monday. Over the last five days, the Boston-based firm’s shares have declined by 8.1%.

PENN Entertainment, also Nasdaq listed, suffered a damaging 9.5% fall. Over the course of a five-day reporting period, the operator’s value has slumped by 18.7%.

Caesars Entertainment and Rush Street Interactive endured similar fates, with share value decreasing 4.3% and 5.3%, respectively.

Boyd Gaming Group also recorded a near 4% decline by market close, with the operator’s share value down 14.6% in the past month, despite strong Q4 2024 results for its interactive division reported in early February.

Suppliers have also suffered on the stock market in light of tariff concerns, with Genius Sports, listed on the New York Stock Exchange (NYSE), recording a 5.1% decline on Monday.

Sportradar stock fell 4% and has shown little sign of a resurgence, dropping a further 2.88% in pre-market trading to $18.91 today, 11 March.

By market close on Monday, affiliate Gambling.com Group’s share value had fallen by 5.1%.

Outside of the sector, Elon Musk-owned Tesla suffered an 15.4% drop on Monday, while AI titans Nvidia recorded a decline of 5% to $106.98 before closing.

Last week, President Trump placed 25% tariffs on goods imported from Mexico and Canada, though he rowed back 48 hours later stating the new rate would not come into effect until April 2.

He also doubled the rate of duties on Chinese imports to 20%, which has since been met with a response in the form of China applying new tariffs of up to 15% on all US exports.

Soon after, during an interview with Fox News, Trump was pressed for comment on whether the world’s largest economy could face a recession by the end of the year, with his response doing little to allay fears.

“I hate to predict things like that,” he remarked. “There is a period of transition because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing. It takes a little time, but I think it should be great for us.”

Speaking to the BBC, KCM Trade chief analyst Tim Waterer noted: “Trump is keeping political leaders guessing regarding his next moves on tariffs, but the problem is that he’s also keeping investors guessing and that’s reflected in the dire market mood.

“While recession talk may be premature, the mere prospect of this coming to fruition is enough to put traders into a defensive mindset.”