IGT posts $2.5bn revenue for 2024 as asset sale to Apollo looms

Supplier records flat revenue year-on-year despite sustained lottery growth during “year of monumentous transformation”

IGT has generated revenue of $2.5bn for full-year 2024 as management prepare for the sale of the group’s gaming arm to Apollo.

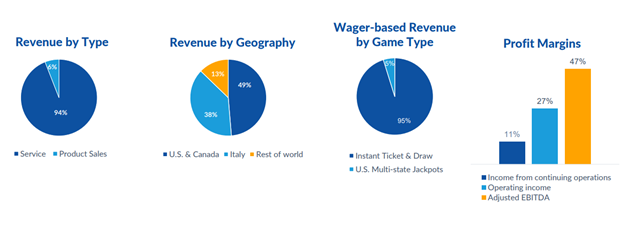

Service revenue for the year came to $2.4bn, with instant ticket and draw game revenue making up $1.9bn of that total. Product sales added a further $149m, down 13% from the previous year.

The US and Canada continued to be the supplier’s most lucrative region, contributing 49% of the revenue total. Revenue from Italy made up 38%, while the Rest of the World (RoW) added 13%.

North America revenue for the year came to $1.2bn, with Italy adding $968m, and RoW contributing $321m.

IGT partly attributed the revenue to strong same-store sales growth across its active markets, with Italy in particular experiencing a 4.1% increase in that metric.

Across the US, elevated multi-state lottery activity was a contributing factor to FY 2024 performance.

This was aided by IGT extending lottery contracts in the likes of Tennesse, North Carolina (both 10 years), Mississippi, and Virginia (both seven years). The company also signed a seven-year contract with Colorado Lottery in July 2024.

In Europe, IGT also secured lottery extensions in Germany, Lithuania, and France, as well as new contracts in Luxembourg, Spain, and Portugal.

Operating income for 2024 year came to $686m, down 9% year-on-year (YOY) from $752m.

Adjusted EBITDA for the year amounted to $1.2bn, representing a 4% decrease on the previous year.

During the year, IGT also announced the sale of its Gaming & Digital arm to Apollo Global Management in a $4.1bn deal.

The sale is expected to close in Q3 2025, with a significant portion of the cash expected to go towards debt reduction and returned to shareholders.

In terms of Q4 2024, IGT recorded revenue of $651m, down 4% YOY.

Operating income for the quarter decreased 9% YOY to $179m, while adjusted EBITDA dropped 8% YOY to $290m.

The supplier highlighted negative foreign currency rates as a reason for the decreased revenue and profit for the quarter.

IGT CEO Vince Sadusky claimed the company was in a strong position following a year of transition.

He said: “2024 was a year of momentous transformation with the conclusion of our strategic review and the announced sale of our Gaming & Digital business for $4.05bn in cash.

“Our unmatched capabilities in developing world-class lottery solutions and innovative game content support several important investments to drive long-term growth and shareholder returns. We are well-positioned to continue strengthening our global lottery leadership.”

Looking ahead to 2025, IGT included revenue projections of $2.55bn to $2.65bn for the 12 months, as well as adjusted EBITDA between $1.1bn and $1.15bn.

The company has also set goals of winning important contracts in both Italy and Texas, as well as “identifying structural cost savings to drive greater efficiencies across the organization.”

At the time of writing, IGT’s share price sits at $17.94, up from $17.31 at market open.