FanDuel and DraftKings dominate Maryland July sportsbook numbers

Free State online sportsbooks net $237.5m in handle and $20.5m in revenue as traditionally quiet period for sports continues

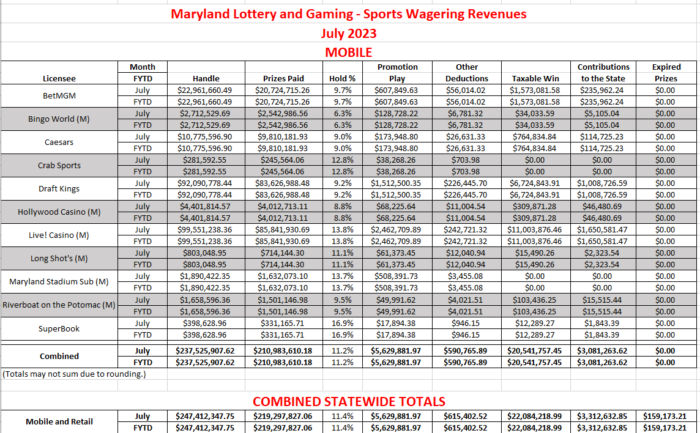

Maryland retail and online sportsbooks took a combined $247.4m in handle in July, according to latest data released by the Maryland Lottery and Gaming Control Agency (MLGCA).

The state’s 11 online sportsbook operators took $237.5m in the month, generating a taxable revenue of $20.5m and paying just over $3m to the state in the form of gross gambling revenue (GGR) tax.

Operators exempted $5.6m from the total taxable revenue in July, as provided for under the state’s gambling laws, with the Maryland market operating with a hold percentage of 11.2%.

In respect of operators, FanDuel and its partner Live! Casino continued its dominance of the market, racking up $99.5m in handle over July and taxable revenue of $11m.

DraftKings was just behind its longtime rival in the Maryland rankings in July, handling $92m in bets and generating taxable revenue of $6.7m.

The duo were way ahead of third place BetMGM, which took $23m in bets, generating taxable revenue of $1.5m in the state.

The Barstool Sportsbook at the Hollywood Casino saw $4.4m in handle over July, generating a taxable revenue of $309,871.

The Barstool Sportsbook is one of a number of sportsbooks across the US which will be rebranded to fit parent company PENN Entertainment’s new $2bn alliance with US sports broadcaster ESPN, which was confirmed last week.

Fanatics Betting and Gaming and its partner, the Maryland Stadium, racked up handle of $1.8m but no taxable revenue, exempting $511,847 in the form of promotional play and other deductions during the month.

Maryland-based sportsbook operators are taxed at a rate of 15% of their respective GGR, but can deduct promotional play credits and other forms of deductions from this total.

Sportsbook handle is taxed at a rate of 0.25% in the state under federal excise tax law.