US Operator Tracker Q3 2024: 'Big two' brands pull away from field as bettor fatigue sets in

FairPlay Sports Media looks at whether the dominance of DraftKings and FanDuel is creating player apathy or if challenger brands need to up their game

FairPlay’s Brand Perception Tracker has monitored bettors’ opinions of the US market for four consecutive quarters now, providing an increasingly insightful snapshot of how the country’s regulated sportsbooks are perceived on features and brand strengths.

Q3 data has now been compiled, looking at a sporting period that initially saw a lull on core US sports outside of the MLB, but was then dominated by pre-season hype around the NFL season.

The broad stroke picture that this tracker shows is that the hegemony of the leading brands remains, with market share generally staying static with no major spikes from challenger operators in chasing the ‘big two’ of DraftKings and FanDuel.

However, there have been signs of bettors’ fatigue, potentially following a heavy marketing push in the lead-up to the NFL season or the seasonality of the survey, with ‘awareness’ scores for DraftKings and FanDuel down 8% and 9% respectively. It should be noted that this is within a wider market trend, with all tracked brands falling away, with the most notable drop being BetMGM (down 12%).

In the hotly contested battle for wallet share among the standout market leaders, it is DraftKings which is winning out against FanDuel in terms of brand ‘favoritism’ (36% vs 31%), while also over indexing against the market on ‘best odds.’

FanDuel has risen to be level on ‘regular usage’ with 53% of those surveyed using both brands more than occasionally, while they have also edged clear on some bet offering metrics, particularly on parlays — a significant lead considering the importance of this kind of multiple bet within the ongoing NFL and incoming NBA seasons.

When looking at conversion rates from holding an account (1.94 accounts held on average by those surveyed) to regular usage, DraftKings leads FanDuel by 67% to 59%, with similar scores across both brands for the number of regular bettors who use their accounts to bet daily. These figures almost double for the next best brand in terms of daily usage, with ESPN Bet only seeing 35% of customers returning on that regularity.

The likes of BetMGM (47%), bet365 (50%), and Bally’s (56%) are still converting strongly to ‘regular usage,’ albeit not to the same levels as the leading two brands.

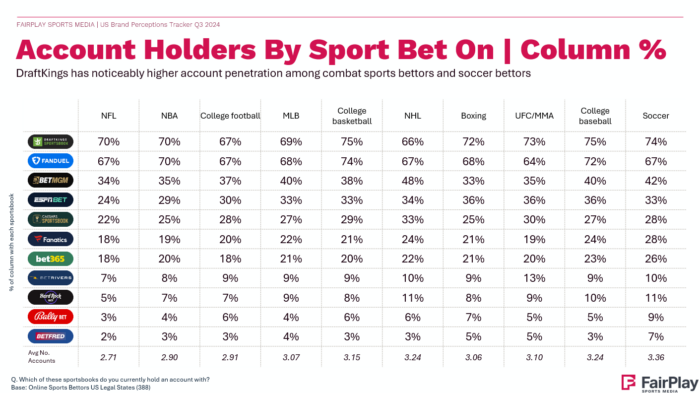

Looking at perceptions by sports bet on, DraftKings and FanDuel are in parity when it comes to NFL, NBA, and college football, but the former is seeing far better penetration on some alternative sports, particularly combat sports and soccer.

FanDuel has stronger cut through with regular NBA bettors, which may suggest a more consistently strong pricing and product offering which appeals to customers above the recreational level.

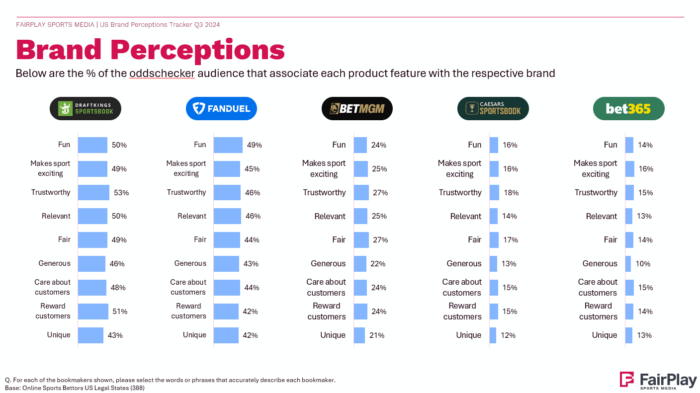

DraftKings and FanDuel continue to dominate on every brand perception metric, with both well clear of BetMGM, which itself is clear of the likes of Caesars and bet365 when it comes to associations for ‘fun,’ ‘makes sport exciting,’ and ‘trustworthy.’

The leading pair remain under indexed by between 2%-3% for being ‘fair,’ which could perhaps imply market maturation with the brands’ potential scale having a negative effect on how they treat customers, with FanDuel also ranking below expectations by 3% for ‘care about customers.’ Positively for FanDuel, it is the only brand of the top five to overperform in ‘fun’ association, doing so by 2%.

In terms of the survey’s output for feature awareness, DraftKings continues to lead on ‘best odds,’ ‘promos/free bets,’ but is edged out on parlays, as mentioned earlier, by FanDuel, as well as on its ‘cash out’ provisions.

As a general theme, the challenging brands have struggled to differentiate themselves on features in the latest results, with indexes coming in around expectation on almost all metrics. Whether this suggests there’s still some room to develop an identity or whether the ‘big two’ dominance is creating apathy remains to be seen.

About FairPlay Sports Media

EGR and FairPlay Sports Media have partnered to bring a data-led, quarterly report on brand perception of leading firms in the sector.

These insights are produced by FairPlay Sports Media senior customer insights manager Peter Morris. He has more than a decade of experience working in market research, starting his career working at agencies Ipsos Mori and then 2CV, with a particular focus on brand and marketing research projects.

In 2018 Morris joined what was then Oddschecker, focusing on UK product and marketing insight. Since then, he has expanded his role, heading up customer insight within FairPlay Sports Media, providing intel across all their operations and territories.