Slice of the action: Inside The Stars Group’s aggressive Australia M&A

The firm’s $433m entrance into the Australian sports betting market raised more than a few eyebrows around the industry, but the potential impact on the US market could be flying under the radar

PokerStars dealt its last digital hand of poker in Australia on 11 September 2017, pledging to return as and when it could. But no-one expected The Stars Group to be back in Australia so soon and in such different circumstances.

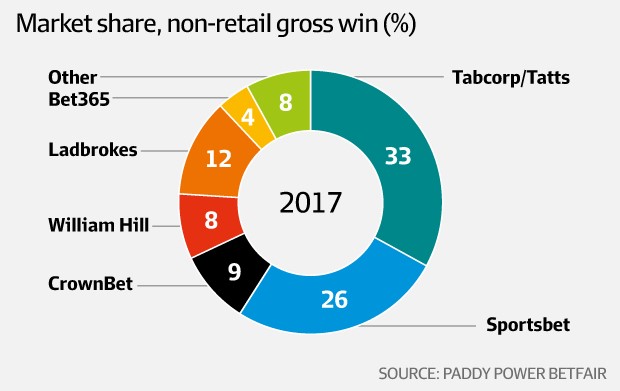

At the beginning of March, Stars triggered a chain reaction of acquisitions that ultimately saw it owning an 80% stake in Australian online bookmaker CrownBet, which, in turn, had acquired William Hill’s Australian business. It means Stars suddenly finds itself in control of two online bookmakers each with around a 29% stake in the Australian betting market – itself the second-largest betting market in the world.

To reach that position from a standing start took a hefty chunk of cash – around $433m all told – and a healthy dose of strategic vision. “It was a very impressive bit of business,” suggests Yaniv Sherman, SVP and head of commercial development at rival firm 888.

It is all the more impressive given it came completely out of left field. While Stars’ appetite for regulated sportsbook revenues is well-known, it has been linked with the likes of William Hill’s international business rather than any Australian firms. And for good reason. The hunt for regulated revenues has always been about putting more volume through the BetStars sportsbook platform, which the CrownBet deal doesn’t do, because it comes with its own platform. Likewise, Stars is arguably the best in the world at cross-selling between poker, casino and sports, whereas Australia has banned the first two verticals.

Keep it simple, stupid

So just why has Stars dropped close to half a billion dollars on entering a new market? Well, Occam’s Razor suggests the simplest theory is often right, and in this case, it could simply be that Stars sees CrownBet and Hills as a bolt-on acquisition that can deliver value in its own right, especially when combined.

Stars said the business will generate gross synergies of $39m per year from 2019, enough to overcome the looming threat of nationwide Point of Consumption (PoC) taxes in Australia – the existence of which is why William Hill decided to offload the business in the first place. Hills sold up at little better than 6x EBITDA, and if Stars can mitigate that risk with scale it already counts as a win.

Analyst firm Regulus Partners also noted the combined firm could deliver more than the sum of its parts, thanks to scale as well as CrownBet’s well-respected platform and management team. Indeed, the CrownBet management team, which will be running the two Australia businesses on behalf of Stars, is one of the underrated aspects of the deal.

Several analysts speculated that the addition of CrownBet CEO Matthew Tripp to the Stars executive team was a major coup. Canaccord Genuity’s Simon Davies described Tripp as a “highly experienced and incentivised entrepreneur/founder whose skillset could be useful as Stars attempts to develop its own sports offering.”

Meanwhile, Eilers and Krejcik Gaming noted how Tripp was considered “something of a rock star in his native Australia, having previously founded, scaled up and sold the Sportsbet business owned by Paddy Power Betfair.”

“We think we have the expertise to do really well there. So I think I could be spending more time in North America” – Matthew Tripp, CrownBet

The analyst added: “His knowledge of the sports betting business will likely be an asset to TSG as they look to expand into other regulated markets, although we’d be wary of overstating the benefit of acquiring expertise that sits in a time zone some 11 hours ahead of management.”

Australian analyst Killian Murphy said the deal “showed what an amazing job” Tripp has done at CrownBet. “Against some of the largest and most sophisticated betting brands, he has built CrownBet up to a significant player in the market and the clear number two,” Murphy stated.

“Despite the harsh regulatory environment (which is highly unlikely to change in the near-to-medium term), there is still a large runway for growth for the corporate bookmakers as they take share from Tabcorp’s retail tote product.”

Getting the brands back together

Before that growth can be realized, Stars has a big decision to make in Australia, chiefly which brand it will use to operate under. The CrownBet brand is owned by land-based operator Crown Resorts, which will resume control of the name next year, while the William Hill brand never really took off. Possible options could include other brands owned by Hills, such as Sportingbet or Centrebet, or even a launch of BetStars, which Stars uses for its sportsbooks around the world. Stars declined to comment when contacted for this article, saying that it was in a quiet period ahead of its FY17 financial results.

While the opportunities Down Under could be enormous in their own right, the acquisition also carries several ancillary benefits, as one would expect from a firm with an executive dedicated to M&A in the form of chief corporate development officer Robin Chhabra.

The first of these is some increased sway in Australian political circles. In the immediate aftermath of the laws that forced firms to stop offering poker and casino in the country, it was perceived that poker stood a fighting chance of being re-regulated at some point. Indeed, Australian communications minister Mitch Fifield has said the government is supportive of licensing online poker, although no further movements have been made in 2018.

PokerStars could feasibly use its new-found presence and lobbying experience to push that agenda forward, with Tripp noting in a recent interview: “They [Stars] are keen on Australia as well with the potential for the ban on online poker to be lifted here.” If that ban is indeed lifted, the potential for cross-selling between the verticals would give Stars a major edge over its competition.

From sea to shining sea

The opportunities for Stars extend beyond Australian shores, of course, with several analysts speculating the acquisitions were made with one eye on the US. Specifically, US sports betting where CrownBet’s proprietary platform could be offered to US casinos. “We believe [the acquisitions] give us the tools we will need to prepare for potential positive regulatory movement in other jurisdictions,” Tripp hinted after the deal.

Eilers & Krejcik Gaming added: “CrownBet has three years’ experience of working with a land-based casino brand and has integrated its land-based rewards system into the site. The business also operates on a separate, proprietary platform from Stars’ other operations and as such should be a simpler process to roll out for operators in the US.”

Stars is already live with poker and casino in New Jersey through a partnership with Resorts Casino, while it is also planning to launch in Pennsylvania later this year. Adding the CrownBet sportsbook platform to its offering could make it a very attractive B2B partner.

When asked specifically about the US market following the deal, Tripp responded: “We think we have the expertise to do really well there. So I think I could be spending more time in North America.”

There is a knock-on effect of the deals in the US as well, with William Hill saying it would turn its focus stateside without the distraction of Australia. “The disposal will allow William Hill to focus on continuing to grow our UK online and US businesses, particularly as we prepare for the decision on the PASPA appeal due in 2018,” CEO Phillip Bowcock said.

The firm, which recently applied for a New Jersey license, reported a $10m rise in operating costs as it prepared itself for expansion should PASPA be stuck by the Supreme Court. The money largely being spent on expanding the headcount and office space.

The operator is positioning itself for B2C and B2B opportunities, with the option of leading with its own brand, finding a joint-venture partner or even acting as a supplier through its proprietary self-service betting terminals. Stars maybe gearing up for the US, but it won’t be short of competition.

One piece of the puzzle

The final point to consider from the acquisitions is the impact on Stars M&A going forward. As previously noted, CrownBet and William Hill Australia don’t fulfil Stars CEO Rafi Ashkenazi’s goal of more regulated revenues to put through the BetStars platform. As such, the near half a billion dollars spent on the two firms could just be part of the solution, with Stars saying in recent months it has the firepower for several big deals thanks to its falling debt and strong cash flow.

Irish analyst firm Goodbody noted Stars’ leverage was at lower levels than the recent past, suggesting a “bolt-on deal like this [CrownBet] will not be seen as something that may stop its M&A ambitions.”

Eilers and Krejcik added: “CrownBet does not appear to solve any of TSG’s existing issues around sports betting, namely scale, product and brand, although it does undoubtedly add a new layer of operational expertise. The rationale for pursuing a large-scale target in the European sports betting sector remains intact in our view.”

Where it remains intact is anyone’s guess, but the rumors persist that William Hill is in Stars’ crosshairs, fueled by the fact that Stars recently hired Andy Lee from Hills to lead the BetStars sportsbook. Chhabra made the same switch last year.

Stars’ rapid and dramatic entrance in Australia seems to make sense on a few levels. Combining the CrownBet and William Hill businesses itself could be a strategic masterstroke, with the combined outfit possessing the scale, technology and talent to take on the biggest players in the market.

The potential return of online poker also offers a material upside, while bringing the highly regarded Tripp into the fold bolsters an already star-studded executive team. Finally, the CrownBet platform gives Stars an obvious route into the potential Nirvana that is US sports betting. All in all, it would appear to be $433m very well spent.