Optimove Insights Pulse report: US sports bettors growth surges to 187% in November

In this month's column, Optimove reveals US retention rates among new players surged to 49% in November, up 19% over last year

The remarkable sports bettors growth in the US shows no signs of slowing, Optimove Insights’ iGaming Pulse reveals. Since September, the US has outperformed the global average, which remains stable around 100%. After a sharp spike to 175% in September, growth continued its upward trajectory, reaching an impressive 187% in November. The US market is clearly setting the pace for global sports betting trends.

For US operators, this surge presents a golden opportunity to capitalize on the growing market by refining retention strategies, leveraging personalization, and engaging bettors with targeted campaigns that build loyalty and drive higher lifetime value.

US sports total betting amounts surge to 204%, doubling the global average growth

The growth in US sports bettors is driving an equally impressive rise in total betting amounts. While the global average remains steady at 100%, the US has seen significant increases. Starting in September, betting amounts surged to 171% and continued climbing, reaching an incredible 204% in November —more than double the global average. This sharp rise reflects the growing engagement of US bettors and the strong link between increasing player numbers and higher betting activity.

For US operators, this trend underscores the need to focus on player engagement and retention strategies. By leveraging data-driven insights and personalized marketing, operators can maximize this growth, encourage sustained betting activity, and build deeper loyalty with their player base, particularly in the months preceding the NFL playoffs.

Only 2% of US sports bettors become multi-product players, falling behind the global average

Globally, an average of 6% of players transition into multi-product users each month, engaging with both casino and sports offerings. In the US, however, this figure lags significantly, with only 2% of sports bettors making the switch to multi players. This underperformance highlights a missed opportunity to deepen player engagement and drive retention.

For US operators, the recent surge in sports bettors presents the perfect moment to address this gap. By implementing data-driven cross-sell campaigns — such as personalized offers, loyalty rewards, and dynamic content — operators can encourage sports bettors to explore casino offerings. This not only enhances the player experience but also boosts long-term retention and revenue growth.

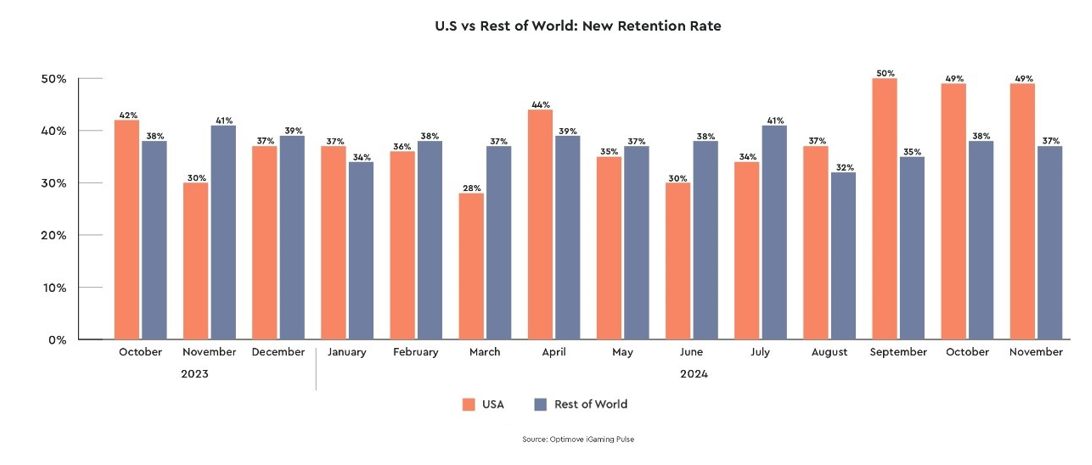

New depositor retention surges to nearly 50%, outpacing the global average

Retention rates among first-time depositors have seen a significant boost over the past three months, with a 15% increase in the proportion of new depositors remaining active in the month following their first deposit, compared to the average retention rate before September 2024. While global retention rates have held steady, the US has surged ahead, reaching an impressive 49% in November — 19% higher than November 2023.

For operators, this upward trend underscores the importance of nurturing new depositors early. Strategies such as personalized onboarding journeys, timely follow-ups, and loyalty rewards can help sustain this momentum, turning first-time depositors into long-term, engaged players.

Stay tuned for Optimove’s iGaming Pulse report to be published next month.