Operator Tracker Q1 2024 US: A first look at FairPlay Sports Media’s proprietary insights

FairPlay Sports Media dives into some key trends emerging from the US in the first feature as part of a new partnership with EGR North America

Running since 2021 in the UK and 2023 in the US, the FairPlay Sports Media Operator Tracker has analyzed brand perceptions of leading sportsbooks to derive truly valuable insight that assists industry stakeholders and internal brand teams with strategic planning and market positioning.

In this ongoing quarterly feature, we will be sharing the latest tracker data with EGR readers to provide a more analytical foundation to their existing understanding of how sportsbooks are perceived in the burgeoning and dynamic market across the US as a single entity.

For further information on the methodology, history, and purpose of the Operator Tracker, please click here.

Despite the early involvement of various established European operators and suppliers within the US post-PASPA, the Atlantic seems to be getting wider with a more localized concentration of brands and their underlying tech platforms.

This is critical to note when we look at US brand perceptions versus markets such as the UK, where sportsbooks have been able to position themselves with marketing and product messaging over decades.

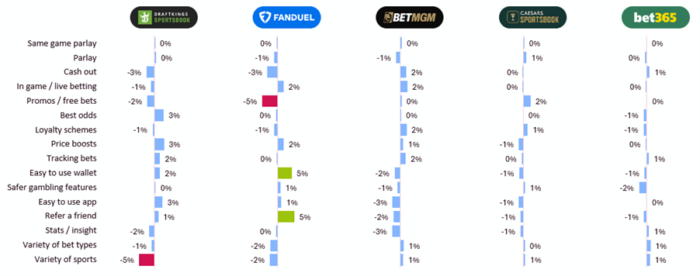

US brands have faced off in regular state openings that has led to costly acquisition campaigns and sidelined concerted brand development strategies, as we can see from the chart below, which shows little differentiation between brands in terms of their perceptions.

With these campaigns focusing mainly on free bet signup offers, more nuanced messaging has yet to truly cut through, with brands lacking distinct personalities as we see in other territories.

The likes of FanDuel and DraftKings have dominated the early years of the US market, yet they have struggled to create a clear brand identity. FanDuel, for example, has a small advantage versus its competitors in ‘easy to use wallet’ and ‘refer-a-friend’ offers, which are probably not central objectives of the operator’s brand teams.

What we’re excited to see from this Operator Tracker data going forward is how the audience evolves as new demographics emerge, as engaged bettors or individuals change their own preferences and attitudes to betting offerings and brand propositions.

Over time, we fully expect to see sustained differentiation between brands and their perceptions in the US. Brands will look to communicate more about what makes them unique from the competition. Acquisition campaigns are already showing a lack of sustainability due to extreme CPAs, and so consistent messaging that demonstrates their true strengths will be a key tool in stealing market share from their competitors both nationally and state by state.

These brands, both local to the US and international entrants, will be close to deciding what exactly they stand for and, as we’ve seen in the UK, consistency of communication is fundamental to portraying a well understood, engaging brand over time.

For example, in the UK, the likes of bet365, which focuses on repeated product-first messaging around in-play and bet builder offerings, and Paddy Power, with its relentless pursuit of humor, are prime examples of how long-term marketing strategies can create clear brand propositions with a strong foundation.

Sportsbooks in the US will do well to understand their betting audience and put their needs first. We’re already seeing considerable distinctions between the US and UK bettor that some may have seen as fairly comparable in earlier days.

Building out that knowledge base via internal data and operator trackers such as this will enable a successful path to finding their personality, while giving brand teams the chance to create unique strategies with genuine resonance and longevity.

EGR North America and FairPlay Sports Media have partnered to bring a data-led, quarterly report on brand perception of leading firms in the sector. These insights are produced by FairPlay Sports Media senior customer insights manager Peter Morris.

Morris has more than a decade of experience working in market research, starting his career working at agencies Ipsos Mori and then 2CV, with a particular focus on brand and marketing research projects.

In 2018, he joined what was then Oddschecker, focusing on UK product and marketing insight. Since then he has expanded his role, heading up customer insight within FairPlay Sports Media, providing intel across all their operations and territories.