Finding the right free-to-play formula

Barely a day goes by without the launch of a new free-to-play (F2P) prediction product in the US. Members of the F2P party now include Fox Bet (of course), MGM and Buffalo Wild Wings (less predictably), the Los Angeles Rams, MLB, the NBA and even Pepsi (in partnership with DraftKings).

It appears that no-one needs convincing of the merits of F2P in preparing sports bettors. Chalkline CEO Daniel Kustelski claims products like his firm’s F2P platform can acquire customers at between $20 and $30 with around a quarter of them going on to become real-money sports bettors. That works out at an average CPA of around $100 – a fifth of the going rate in New Jersey, although Kustelski is quick to play down comparisons between New Jersey and the rest of the country.

“NJ is almost like this petri dish of testing and it’s tough to compare with other states because they’ve got this igaming component, where people are acquiring customers on sports, and then pushing them over onto online casino which makes them really valuable,” he says. In other words, customers in other states around the country probably aren’t worth $500 a head, but there’s still plenty of margin to be made at a $100 CPA.

Failure to prepare is preparing to fail

The F2P concept has come to the fore in the US because it’s seen as an efficient way to acquire customers in states where sports betting isn’t yet available – assuming that is, you aren’t a DFS brand. As gaming marketing expert Brendan Tinnelly noted earlier this year: “Having an F2P product sidesteps the wait for regulation.”

Fox Bet of course helped popularize the model – itself copied from Sky Bet. Fox Bet’s free-to-play Super 6 app was downloaded more than 280,000 times in the nine days after launch on the Google Play and Apple App stores. It also ranked in the top 20 in Apple’s US App Store games tab and top 10 in the sports section of the App Store’s game category.

And games like Super 6 have benefits beyond warming up customers for an eventual RMG app. In the UK, for instance, customers acquired via F2P tend to be stickier, according to Fox Bet CEO Robin Chhabra. Users make their picks and can be upsold into placing a bet on their selections, but they also invite their friends to play in prediction leagues creating a network effect and regular activity that’s carried over into RMG. Around 60% of Sky Bet customers only bet with Sky Bet, suggesting the company is indeed reaching customers that traditional bookmakers can’t. “We’ve said all along that Sky Bet retention is off the charts compared to other firms in the industry and that’s a lot down to free-to-play,” Chhabra said earlier this year.

Finding the model

So is there a particular method that operators should be focusing on? There’s a myriad of examples in the market already from DraftKings’ co-branded effort with Pepsi that asks players questions like ‘Will Kirk Cousins throw an interception?’ to concepts like BallStreet Trading, which lets users trade live sporting events, with the most profitable trader winning a prize.

The simpler prediction games, à la Fox’s Super 6, are useful engagement tools but the optimal strategy is a game that educates players about sports betting terminology and mechanics, Chalkline’s Kustelski says.

“What I am seeing a lot of is just pure-engagement games,” he says. “What’s the next play going to be, who’s going to win, without there being odds or any educational component to that.

“You know what, a 30-point favorite in college football is probably going to win. But that’s not really teaching you about sports betting. I think it’s more important to have products with real odds from real providers like Kambi and SBTech that can teach consumers about what $10 at -110 pays out, or what a three-team parlay is.”

The dream customer

What is often overlooked about F2P games is the type of customer they can attract; typically the recreational player chucking a few dollars on a parlay. These customers are the holy grail for any regulated sportsbook operator, and the type of customer that helped build Sky Bet into the giant it is today.

“Something like 30 million Americans are going to place their first bets over the next three to five years,” Kustelski says. “So, all we’re doing is literally just focusing on that. US operators are holding something like 40% of handle on parlays. That’s where the money is.

“This is an amazing opportunity for sportsbooks to quit worrying about a couple of sharp bettors that are complaining about getting their accounts closed, and focus on those products that transition people from being a sports fan into a sports bettor.”

Wider audience

Free-to-play isn’t just limited to betting operators trying to turn sports fans into bettors. A handful of land-based casino operators have long run social casino equivalents to keep customers engaged off-property, and if nothing else, the products give traditional retail firms a crash course in digital marketing.

Kustelski adds: “I think that it is a really good step and something that almost all casinos should do now. It allows you to really understand, just through trial and error, how to engage with customers.”

High bar

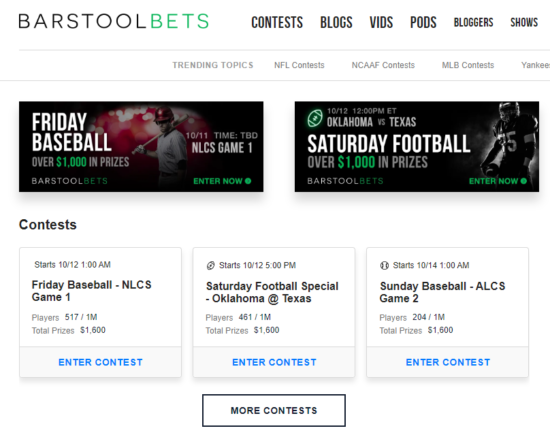

F2P is also not limited to gambling operators. Chalkline currently provides the tech for Barstool Bets, a free-to-play book run by the outspoken media group Barstool Sports. Barstool has been one of the biggest beneficiaries of the repeal of PASPA thanks to its audience, which largely consists of prime potential sports betting customers – young men. To date, Barstool has agreed advertising partnerships with the likes of FanDuel and PointsBet, but the launch of Barstool Bets suggests it sees F2P as a way to become more than just an advertiser and get properly into the affiliate business.

“We are trying to build this huge database throughout the country of people who know how to gamble,” Barstool CEO David Portnoy told Business Insider. “When the new states turn on and make it legal, we think we’ll have a powerful database of people who enjoy doing this type of behavior.”

Kustelski says the engagement levels on Barstool Bets have been beyond impressive. “People want to understand live in-play and what it takes to win,” he says. “But they don’t want to lose 10 bucks to learn the lesson.”

It appears this ‘soft’ sports betting product is arguably the way forward for operators looking to acquire customers rather than the simpler prediction games. The PGA Tour’s Norb Gambuzza recently told EGR the Tour had held off from copying the NBA and launching its own F2P games because the concept hadn’t quite taken hold as expected among sports fans.

As a result, Kustelski predicts the industry will transition from Super 6-style games to the more educational concepts complete with odds and proper betting terminology. The upside for operators is hard to ignore, especially at CPAs are multiple times lower than the industry standard at present. So, what are you waiting for?