Robinhood “definitely thinking about” sports betting, says CEO

Vladimir Tenev suggests Millennial and Gen Z users are driving interest as he confirms retail stock trading business “keenly” exploring the space following success of election contracts

Robinhood CEO Vladimir Tenev has revealed the company is “keenly looking into” sports betting contracts following the success of its election contracts launch.

Speaking as part of a near-four-hour Investor Day 2024, the exec was asked whether the retail trading and financial services business was planning to expand into other betting markets.

Robinhood unveiled its election contracts on 29 October, one week before the US presidential election on 5 November.

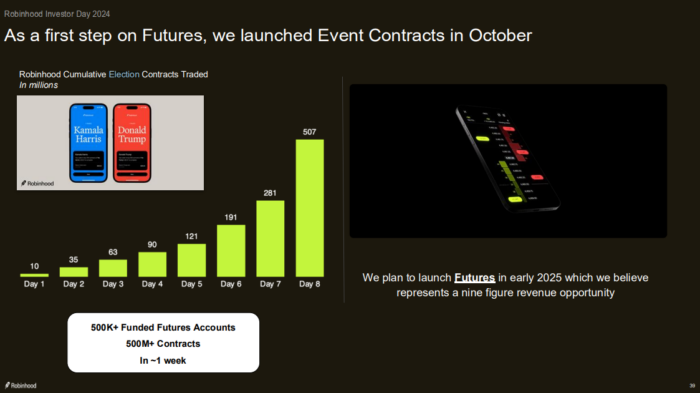

Bosses said the timeline from conception to launch took just two weeks, with $500m traded on the race between president-elect Donald Trump and outgoing vice-president Kamala Harris.

Around 500,000 people opened accounts and made election contracts, with industry stakeholders pondering the possibility of Robinhood making waves in the sports betting space.

What’s more, there were 507 million contracts traded on the election, Robinhood disclosed.

The California-based firm was allowed to offer election contracts via its licence with the Commodity Futures Trading Commission (CFTC), while sportsbooks across the US were unable to offer such markets.

When pressed on whether the success of the election could “open the door” to sports betting via event contracts, Tenev revealed Robinhood was prepared to explore the possibility.

He said: “It’s different than sports betting, fundamentally, because these are regulated event contracts offered through our FCM [Futures Commission Merchant] licence regulated by the CFTC.

“That said, we are interested in exploring all kinds of events, and I think a lot of people have been talking about the potential for sports event contracts and taking that into the regulated space.

“A lot of our customers who index — Millennial and Gen Z — are interested in sports in general, so we’re keenly looking into that space. [There’s] nothing to announce just yet, but it’s so important to our customers and in culture that we’re excited about it.”

The CEO added that while no product was ready to be released to market, Robinhood was actively exploring how it could expand into sports betting.

Tenev said: “Generally speaking, we want to avoid specific product launches at these events. We want to save those for product events. But we’re definitely thinking about it.”

One slide in the Investor Day presentation showed how roughly 50% of Robinhood’s customer base were Millennials (born between 1981 and 1996) while almost a quarter of users were classed as Gen Z (born between 1997 and 2012).

It also revealed that customers were typically high earners, with approximately 45% having an income above $100,000 a year.

Robinhood’s brokerage business boasts 24.4 million funded customer accounts – an increase of 1.1 million year over year.

Chris Grove, Eilers & Krejcik Gaming partner emeritus, previously argued that Robinhood would “absolutely not stop at election betting” as he cited the need to unlock “high-margin growth opportunities”.

Robinhood’s expansion into sports betting was also the subject of the latest EGR Big Debate, as Rivalry’s Cody Luongo and Circle Squared’s Clyde Harris delved into the topic.

Launched in 2013, Robinhood attempted to disrupt the retail brokerage industry in the US by offering commission-free trading and a unique mobile-only trading platform.

The company expanded to the UK earlier this year and has plans to roll out its platform in Asia in 2025.

Robinhood shares were up 3.5% to $40 in trading yesterday on the Nasdaq.