FDJ preparing for €90m fiscal impact from proposed tax increases

State-owned La Française des Jeux also reports expected revenue of €3.1bn for full-year 2024 ahead of French tax hikes set to be introduced on 1 July 2025

La Française des Jeux (FDJ) has reported the proposed incoming increase in betting and gaming tax will reduce its revenue and EBITDA by nearly €90m.

In a statement ahead of the release of the operator’s full-year 2024 results on 6 March, FDJ said revenue and EBITDA was ahead of expectations on the year.

Revenue increased 17% year-on-year (YoY) to €3.1bn if including the contribution from Kindred Group following the completion of the €2.5bn acquisition in October.

Excluding Kindred, revenue increased 10% YoY with French non-lottery revenue up 6%, FDJ said.

EBITDA stood at €792m, growth of 21% YoY, with a margin of 25.8%.

It was also noted that on a pro forma basis, assuming Kindred had been bought on 1 January and based on the business retained by the FDJ, revenue would stand at €3.8bn with an EBITDA margin of 25.5%.

However, in November, the French government approved several gambling tax hikes, with the FDJ noting that the changes in levy rates will have a tangible impact on the business.

With those increases coming into effect from 1 July, the FDJ noted expected performance will be negatively impacted.

Revenue and EBITDA will be reduced by nearly €45m for the financial year of 2025, with a full-year impact of nearly €90m.

FDJ did not provide a breakdown on how the €45m impact would be split across revenue and EBITDA.

FDJ said: “The group has begun to take steps which will have a phased effect and are designed to fully offset the impact of these tax increases by 2027.”

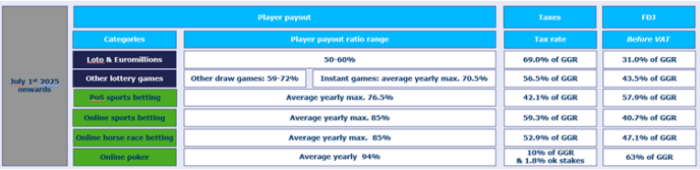

The tax hikes, which formed part of the Social Security Financing Act 2025, included increases in both GGR rates and social security levies against lottery, sports betting and poker.

Horseracing betting was not impacted in the hikes, although there will be a 15% tax on advertising and promotional spend by operators.

The public levy on online poker tax will switch from 0.2% of stakes to 10% of GGR, with the lottery games social security levy jumping from 6.2% to 7.2%.

Lottery GGR tax will rise from 68% to 69%, while draw and instant game GGR tax will tick up from 55.% to 56.5%.

Online sports betting social security levy will rise from 10.6% to 15%, with GGR rate upping from 54.9% to 59.3%. Retail sports betting GGR tax will jump from 41.1% to 42.1%, with social security up from 6.6% to 7.6%.

Betclic CEO and president of French online gambling trade body AFJEL, Nicolas Béraud, commented in December that the proposed tax hikes would “destroy” the regulated online market.