Part three: the challenger brands squaring off against the UK's heavyweights

In the last of a three-part series running this week, EGR shines the spotlight on UK challenger sports betting operators Rhino.Bet and SBK

Rhino.Bet

Launched: 2022

HQ: Bank, London

CEO: Rob Jarrett-Smith

Living up to its unusual name, Rhino.Bet’s ethos is to adopt a different approach to its rivals in the UK. The sports and casino brand is constantly experimenting with new ideas, promotions and ways of attracting and retaining customers. A prime example was during the 2022 World Cup where new customers were offered a free take-away with Uber Eats instead of free bets or free casino spins. CEO Rob Jarrett-Smith says the promotion proved very popular and provided an alternative to its competitors that are able to be more generous with free bets and bonuses. “It was just a different way, at a lower price point really, for us to stand out,” he explains.

While some established operators have gone down the tried-and-tested route of hiring ex-Premier League footballers to act as ambassadors, Rhino.Bet has chosen to invest in grassroots and women’s football. The most notable is its sponsorship deal with National League South team Dartford FC announced in July 2023. Rhino is the team’s official East Stand sponsor, affectionately known as the ‘Rhino Enclosure’, for the 2023-24 season. The operator’s branding will also appear on all training wear for the men’s and women’s team.

However, Jarrett-Smith is quick to point out that the word ‘Bet’ doesn’t appear on its stand or any of the advertising boards in that part of the stadium. He remarks: “Personally, I don’t think it’s a good thing for a football ground where there are children present. It’s fairly obvious what we do and people who are interested can find out. I’m not embarrassed that we’re a betting company, but I think football, particularly grassroots, is often a family event.”

The firm’s CEO is proud to be investing in a local team and getting involved with the community in Kent. Some people have compared the Dartford partnership to the ‘Wrexham effect’, which saw the Welsh football club elevated to new heights following investment from Hollywood A-listers Ryan Reynolds and Rob McElhenney. Jarrett-Smith acknowledges that it has stirred up interest where other clubs, even from League One and Two, have contacted him in order to show their support.

Dartford women’s team has “progressed incredibly” while having had the opportunity to play against well-known sides such as Fulham and Millwall. Rhino.Bet’s CEO highlights that the women’s team is more active on social media, seeing it as a way to boost their profiles further. On the importance of the money invested at this level, he notes: “I don’t think we’re ever going to get the exposure you get from higher-tier football sponsorship obviously, but it feels good. We’re doing a lot of video content about the journey and what it’s like to be a grassroots footballer both on the men’s and women’s side. So, it isn’t simply just about directing bets. There’s a story to be told.”

Outside of sponsorship, Rhino.Bet works closely with its platform partner, Playbook Engineering, to showcase new ideas and test those out in the UK market. With staff hailing from a digital background and senior management having worked at larger tier-one UK operators in the past, ex-Betfair exec Jarrett-Smith describes the employee mix of “old and new blood” as promising young starters within gaming have also joined its workforce, bringing it up to a total of 18 staff across the business. By owning the platform Rhino.Bet sits on, it allows the challenger brand to direct resources to be able to build what it needs when required. Jarrett-Smith observes that “there’s not been a great deal of innovation for a long time” in the industry but the operator has projects under way around bonusing and rewards.

He tells EGR that although it’s difficult to compete in the UK, there is still plenty of opportunity to grab as some of the strongest brands in the early 2000s have since disappeared or merged. “We’ve been realistic in our expectations,” he explains. “We have a very small, streamlined team, we’ve been very willing to take on risk in the way we do things. From day one, we’ve always been keen to offer a service to bettors at all levels. We’re fortunate to have backing and I appreciate a lot of challenger brands can’t do that. But we’ve always taken on some of the bets that other companies would turn away. We want it to be a place where everyone, whatever size of bet, can bet with us.”

Although Rhino.Bet is solely UK-focused, its platform provider, Playbook Engineering, has ambitions to operate globally and is already moving into new markets. While rivals have set their sights on other regions such as the US and Latam, Rhino.Bet’s late entry into the market has meant it’s not burdened by some of the legacy issues. “We have a very strict adherence to compliance policies. We don’t carry any baggage from when the rules were less clear. So, from day one, we’ve done everything by the book, not just because it’s legally a requirement, but morally I think it’s the right thing to do. It means at a later date we won’t have the issues some firms have been having in recent times,” Jarrett-Smith concludes.

SBK

Launched: 2019

HQ: St Katharine Docks, London

CEO: Jason Trost

It’s not every day you see the CEO of a UK-licensed betting company decked out in jockey silks, jodhpurs and boots sitting astride a thoroughbred racehorse. But that’s exactly what Jason Trost, the founder of betting exchange Smarkets, the company behind SBK, did for a controversial video advert – the company’s first – released last year in which he also starred as a moustachioed cricketer and proclaimed that SBK was on a mission to “rewrite the sportsbook”.

The intention was to make a splash in the UK with a glossy TV ad mocking the way rival firms treat their customers. Unfortunately, it didn’t quite pan out that way, and long before the cameras started rolling: “I had no idea about this but there is censorship with ads in the UK and you need to get your script approved,” explains Trost, who hails from the US. “It was amazing the stuff you couldn’t say – it was kind of Orwellian. Of course, you can’t slag off a competitor, but you couldn’t even subtly mention a competitive point against a rival. It was very draconian, so we decided, f*** this, let’s just make the ad we want and put it on YouTube.”

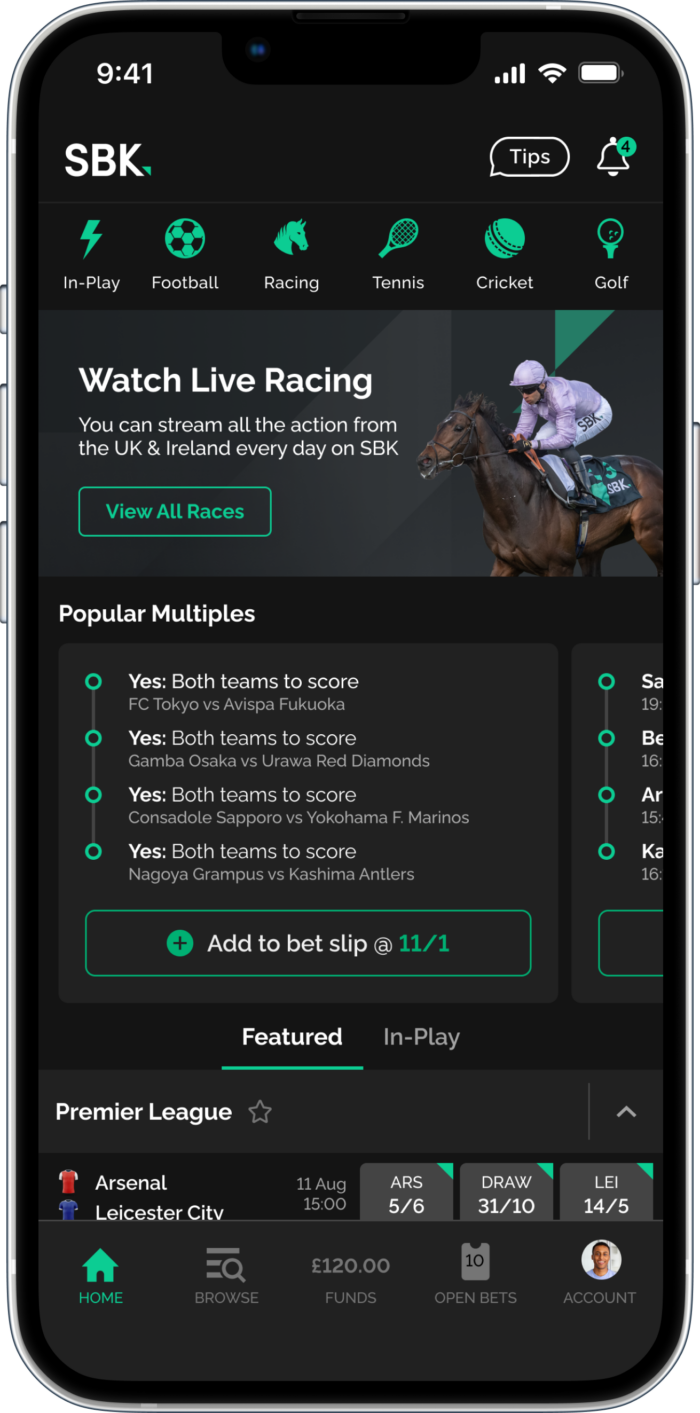

Launched in 2019 and built entirely in-house, SBK is a mobile betting app that resembles the look and feel of a sportsbook, except it isn’t a sportsbook in the truest sense of the word. The prices users are confronted with when they fire up the app comes from the exchange’s customers and the market makers Smarkets uses to generate liquidity, but minus the ‘lay’ odds. The company takes a 2% commission. “The idea is exchange prices with a sportsbook interface,” says Trost. “It’s an exchange that looks like a sportsbook. That’s the secret sauce.” He continues: “One of the big problems Betfair suffered from, and consequently Smarkets, is the [exchange] interface is very hard to understand if you are not someone who is more than a casual bettor.

“I watched Betfair for years try to dumb down their interface or try to make it casual to broaden the audience base and they just couldn’t cross that bridge. The audience for the Betfair Exchange has basically stayed the same for 20 years.” Indeed, despite rapidly growing into the world’s largest betting exchange not long after it was launched back in 2000, Betfair always struggled to prise recreational punters away from the bookmakers. “So, rather than go down the path they took, why not just give casual bettors what they’re used to: a traditional sports betting interface but with the pricing advantage of the exchange,” the 43-year-old boss says.

With its clean layout and fusion of black, green and white colours, the SBK product is as aesthetically pleasing on the eye as it is functional. You could say it mimics the appearance of a financial trading platform like Robinhood. This goes some way to explain why it has an average of 4.6 stars from 1,300 reviews for iOS devices. On Android, SBK has a rating of 4.3 and has racked up more than 100,000 downloads to date. Furthermore, the app’s tight pricing means it offers some of the best odds in the UK, particularly on the Premier League. This was showcased when SBK lined up against the bookmakers on Oddschecker, although SBK recently vacated the odds comparison grid due to “economic reasons”.

Trost says: “It didn’t lead to a lot of acquisitions for us, but it drove awareness because price-sensitive customers go to Oddschecker. We were quite competitive on the odds grid, so I think it drove a lot of underlying volume.” Going after casual bettors means the product should offer the same features as those found with rival apps, so the team has had to create the option for customers to place accumulators.

SBK also now boasts a bet builder product, as well as a ‘quick builder’ where three same-game outcomes are presented as a curated multiple beneath the odds. A user can keep swiping down to swap the treble for alternative suggested bets. “The casual bettor expects these things, but the exchange bettor does not,” says Trost, although he admits he underestimated how long it’d take to build and roll out all these features.

Like Smarkets, SBK doesn’t have a casino. And that’s a deliberate decision. “We have always viewed ourselves as a financial technology company and not an entertainment company, which I think is how most of the industry views itself,” the CEO explains. “Under that lens, a casino doesn’t make sense and we thought it would pull the focus away from the core of what we’re trying to do, which is make sports betting more efficient for the customer.”

Between them, Smarkets and SBK have a 1% UK market share, according to Trost, which is not to be sniffed at in one of the largest and most competitive regulated online gambling markets in the world.He remarks: “I’m proud we’ve built a pretty big business off the back of not much investment.” And all without relying on the power of TV advertising. That’s unless Trost decides to make an ad that sticks to the rules.

A roundup of other challenger brands competing in the UK

QuinnBet

Founded in August 2017, QuinnBet operates in the UK and Ireland as a bookmaker with horseracing very much at its core. The company’s philosophy is focused on giving more back to punters, coupled with fast and efficient customer service response times. Last month, QuinnBet became the official advertising partner of Swindon Town FC for the 2023-24 season, alongside existing sponsorship deals with Dundee United and Hibernian.

DAZN Bet

When sports broadcaster DAZN announced plans to expand into betting, some speculated how a company bankrolled by Britain’s third-richest person, Sir Leonard Blavatnik, might finally nail fusing live sport with gambling. Some, including EGR, were left a little flat when the DAZN BET product launched in 2022, yet bosses insist this is just the starting point of the company’s journey to disrupt the live sport and sports betting experience.

Midnite

Esports-first sports betting platform Midnite made a name for itself in the world of sports betting at the end of last year when it debuted on the Oddschecker grid. The startup also secured a $16m capital injection following a Series A funding round in February 2022 led by investment firm The Raine Group. Developed in collaboration with Sky Bet, Midnite was founded in 2018 by Nicholas Wright and Daniel Qu, creators of UK football DFS platform Dribble.

BetUK

Part of LeoVegas Group’s stable of brands, BetUK has been making waves in the UK market with its horseracing sponsorship deals and strong pricing. This paid off at Royal Ascot as Oddschecker data revealed this challenger brand was seventh in terms of clicks (3.6%). Former striker Adebayo Akinfenwa – known as ‘The Beast’ due to his muscular physique – was enlisted as a brand ambassador just prior to the Cheltenham Festival in March.

Spreadex

It’s probably fair to say Spreadex has historically been in the shadow of spread betting’s largest player, Sporting Index. However, the Hertfordshire firm has been on a march of late with its fixed-odds betting. In fact, Oddschecker data from June showed it had the lowest average overrounds on Premier League 1×2 markets of any bookmaker last season. A razor-thin 102.1% to be precise.

Matchbook

Betting exchange Matchbook returned to the UK market in 2020 following a six-month absence due to its licence being temporarily suspended over social responsibility and anti-money laundering practices. After making significant improvements to its compliance procedures, Matchbook was back in business that same year and this May launched a zero margin and zero commission product.

LiveScore Bet

While parent company LiveScore Group celebrated its 25th anniversary this year, LiveScore Bet – the sportsbook connected to sports media and scores update platform LiveScore – hit its own milestone by breaking record MAU figures in Q2 2023 , and being named rising star at the EGR Operator Awards 2022. The app also underwent an overhaul recently with a focus on improving the overall UX.

AK Bets

Originally established in July 2021 by pro gambler and former Paddy Power employee Anthony Kaminskas, AK Bets expanded into the digital realm with a website and app in 2023. AK Bets is also building a reputation for laying a decent bet, particularly on golf. Kaminskas recently told Irish Racing’s webcast that 80% of AK Bets’ customers asked to prove affordability refuse to comply.

Adam Wilson, founder of Splash Tech and who co-founded B2C operator Bookee, on the headaches facing a newcomer brand in the UK

Congratulations. You’ve figured a way to revolutionise the broken user experience endemic in online sports betting. What’s next?

First up, go and raise some money. Times have changed so you’ll need your incredibly accurate business plan to show how you’ll get to profitability in the very near future.

Next, you’ll probably need a platform to build your product onto, as history tells us you can pump £100m into a platform and sunset it two years later. You can go to a one-stop shop for your every need, but history also tells us that is a terrible idea, so shop around for a sportsbook, PAM and CRM.

So, the money is in the bank, the suppliers are ready to supply, now you are going to need to woo the fine folk of the Gambling Commission. Then there’s a Pandora’s box of compliance, regulatory and commercial goodies waiting to be unwrapped.

We’re live! We have a sportsbook and it’s very shiny. We have created a new feature that we can’t trademark but it’s fine because nobody will copy it or make a significantly better version of it.

But we don’t seem to have any users. Now the fun part: spend, spend, spend. You’ll love running ad campaigns on Meta as they’ll never disable your account, PPC prices will definitely come down soon and affiliates will welcome you like a lost sibling.

Challenger sportsbooks in the UK rarely succeed. The funding ecosystem has changed. There is an over-reliance on outsourced technology and compliance is unsustainable for new operators. Acquisition costs and retention campaigns have become unaffordable, even for tier-one firms.

If you’re thinking of starting a sportsbook in the UK, don’t. Find a niche, get your product market fit and re-sell it to the incumbents.