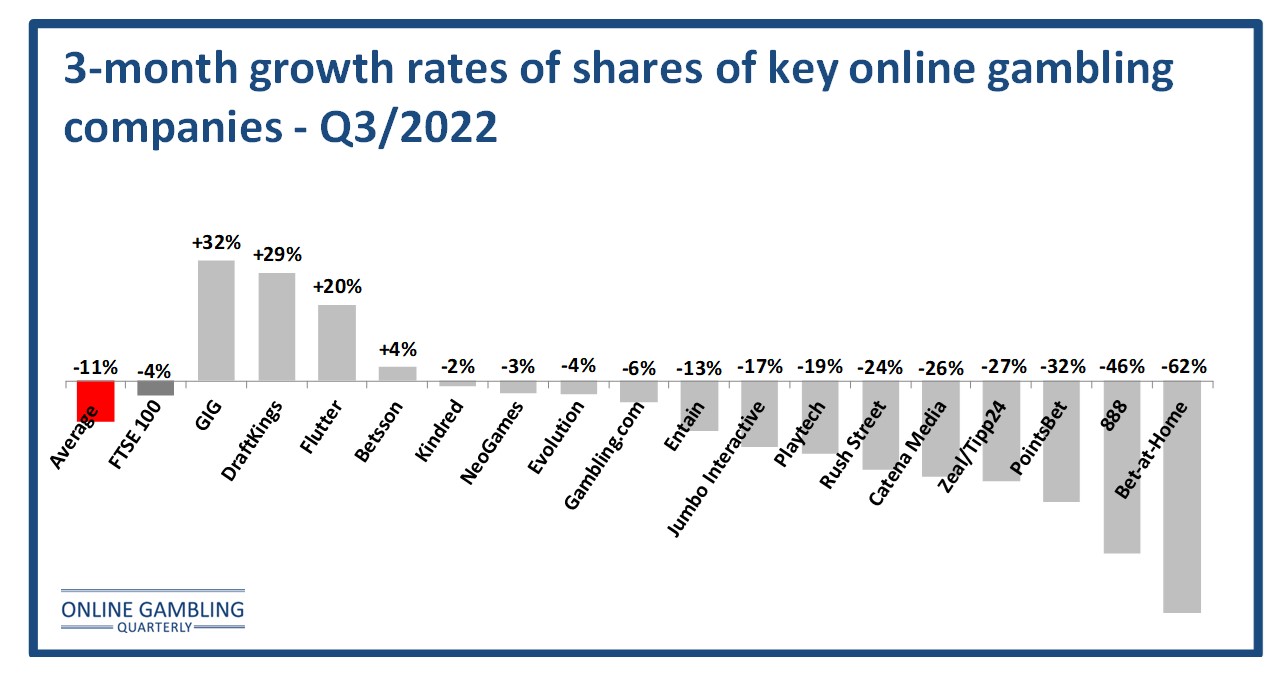

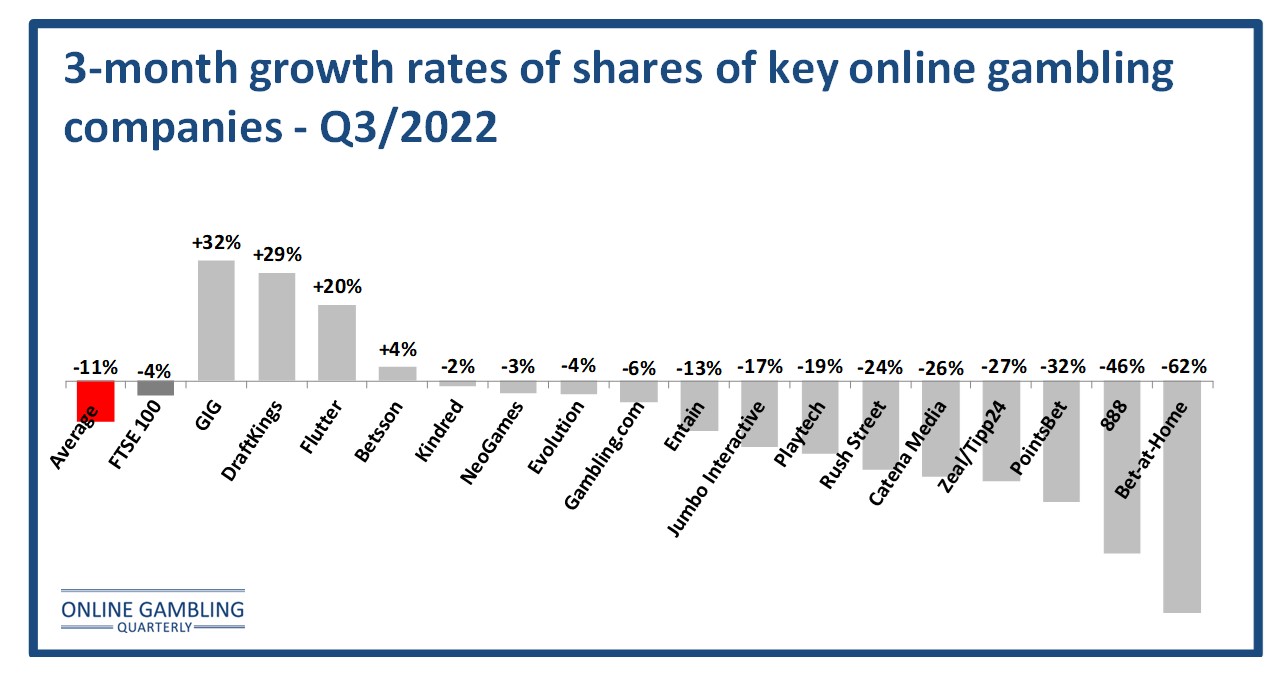

OGQ: GiG and DraftKings are the top growth shares in Q3 2022

Latest data shows a tough quarter for public gambling firms but in line with the overall tech stock decline

Once a quarter, the Online Gambling Quarterly provides an overview of the best-performing shares of online gambling operators and service providers. The biggest leap among the analysed “pure” online gambling companies was taken by Gaming Innovation Group (GiG) with an increase of +32% over the past three months.

Share developments

Again a tough quarter for online gambling shares and a bit “tougher” than for other tech stocks (Nasdaq down -5% in Q3). Below are the key results of the analyses – find here more insights:

- “Winner” – The biggest leap in the sample of online gambling-focused companies was taken by GiG with an increase of +32% over the past three months; followed by DraftKings (+29%).

- “Loser” – Bet-at-home and 888 had the worst three-month performance in the analysis with a decrease of -62% and -46%.

- Average growth – On average, share prices analysed decreased by -11%

- Comparison to FTSE 100 – Compared to the three-month development of the FTSE 100 (-4%), the average growth of the online gambling industry looks “worse”.

- Multi-channel operators – Among the multi-channel operators that also operate a relevant retail business, MGM is the “winner” with a share development of -1% over the past months.

- Comparison to multi-channel operators – It is also interesting to compare the performance of exclusively online gambling companies with that of companies also operating a retail/land-based business. The share prices of the online/retail operators analysed decreased on average by -11% (compared to -11% for the online-only operators).

P/E ratios

The Online Gambling Quarterly also analysed the current P/E ratios for several companies. The ratio provides a good picture of the value of the company.

- NeoGames has the highest P/E ratio – NeoGames leads the ranking with a P/E ratio of 71.

- Average P/E ratio – The average P/E ratio of the sample analysed is 30 (median of 24).

Market capitalisation in relation to Q2 2022 revenue

Traditionally, market capitalisation is correlated to earnings-related figures. But in times of rapidly changing markets (eg., US) and a relevant number of new and growing market players, earnings-related analyses may be less conclusive. Therefore, the researchers also set the market capitalisation in relation to the most recent quarterly revenue (in this analysis: revenue in Q2 2022). For operators, the Online Gambling Quarterly took the net gaming revenue, and for all others (tech providers, affiliates,…) they took the revenue related to online gambling (if reported). In some cases, the revenue reported might not be entirely comparable, but the analysis indicates the market dynamics.

- Evolution has the highest market cap/revenue ratio – Evolution leads the ranking in market capitalisation in relation to the most recent quarterly revenue with 51; it is followed by Scout Gaming (37) and Zeal/Tipp24 (24).

- Average ratio – The average ratio of the companies analysed is 16 (median of 13).